Welcome to ISIF

The INSEAD Student Impact Fund, the leading student venture for global impact at INSEAD targets businesses across every vertical including: Education, Healthcare, Energy and Sustainability, Food & Nutrition, Financial Inclusion and Urban Development.

With our roots founded in business as a force for good, we strive to believe our investments are driving the change we would like to see in the world.

Mission

“To provide a real life learning opportunity for INSEAD students to invest for good in early-stage social and environmental enterprises.”

Our Story

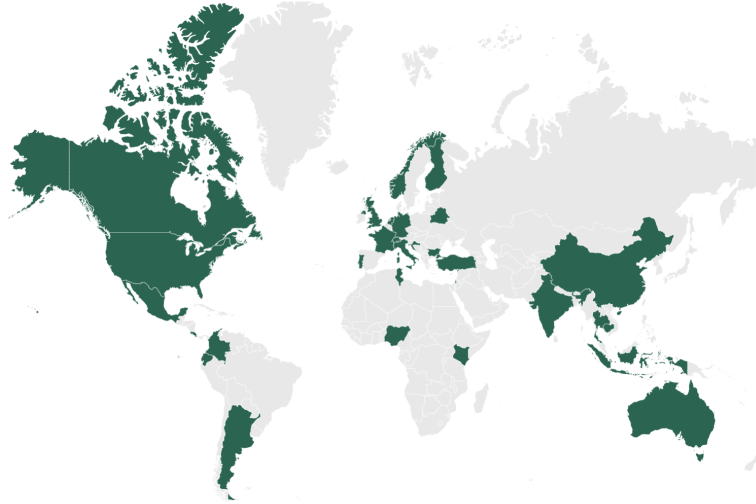

The INSEAD Student Impact Fund began as an endeavour to provide INSEAD students the opportunity to invest for good. Our journey started with the IESE Impact Investment Competition where our students first competed and worked intensely on start-ups in the impact sphere along with investors and startups from Europe and Asia. For students, this was a great learning opportunity to practice their impact investment skills by doing due diligence and negotiating term sheets of an investment. We soon realized that this was a vital opportunity for INSEAD students and decided to partner with INSEAD alumnus founded Loyal VC, an early-stage VC based in Canada to ensure that all INSEAD students had the opportunity to make a difference globally.

After our inception in 2020, INSEAD Student Impact Fund has grown from an innovative idea into a fully functioning student club with 50+ active team members! Since starting, more than 15 impact-led companies have been selected for seed funding with >USD$130,000 deployed through ISIF’s recommendation by our partner Loyal VC.

Goals

The fund was established with a mission to give students opportunity to invest for good, with the guidance of the faculty and professional advisors within the INSEAD alumni network.

Our scope includes deal screening, investment analysis, due diligence and portfolio management. Students gain an exceptional “on the job learning experience” and direct ownership of the investment process.

FAQ

What does ISIF do?

ISIF provides students with a real life learning opportunity to invest for good in early stage social and environmental enterprises. The club partners with Loyal VC, an early-stage VC based in Canada, founded by INSEAD alumni. Each team works with the relevant Loyal contacts directly, led by their respective VP.

What does each team actually do? (5 teams)

Deal Sourcing – works with Loyal to conduct due diligence on impact-focused startups that come into the pipeline, either through us or through Loyal’s existing channels. Team puts together a recommendation for each startup and reports out to the Investment Committee each month.

Due Diligence – conducts extensive due diligence on startups that are already in Loyal’s portfolio and are eligible for follow-on investment. Team puts together a recommendation and reports out for one startup each period.

Impact Assessment – measures and assesses the impact each venture has, with particular focus on the UN Sustainable Development Goals. Team works with both the Deal Sourcing and Due Diligence teams to build a quantitative and qualitative assessment for each startup.

Portfolio Management – conducts mini consulting projects for the startups in Loyal’s portfolio, with an emphasis on matching the team’s skills to the startups requesting help

Fundraising – works with accredited investors in the market to make them aware of our partnership with Loyal and offer them the opportunity to invest

How and when can I apply for ISIF?

We have two recruiting rounds – one in December and one in April for the various divisions:

Impact Assessment

Portfolio Management

Due Diligence

Fundraising

Partnerships

Communications